Discover why townhomes are becoming a popular choice for first-time homebuyers, offering affordability, low maintenance, and community amenities in today's housing market.

Waiting to buy a home in today’s market could cost you more in the long run. Learn why acting now—despite mortgage rates—might be the smartest move for future homeowners.

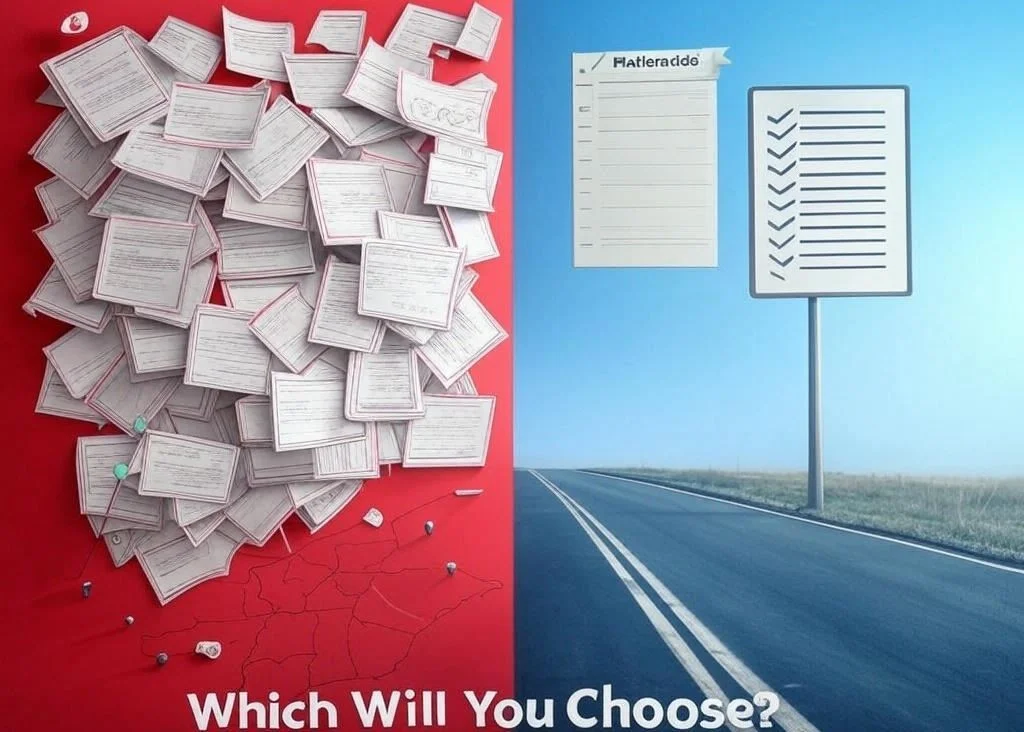

State mortgage licensing isn’t just about application fees—it comes with hidden costs like compliance audits, brick-and-mortar requirements, and slow approvals. Learn how these unseen expenses hurt profitability and why federal licensing is a smarter alternative.

Choosing between state and federal mortgage licensing is a critical decision for lenders. State licensing comes with costly compliance and slow approvals, while federal licensing enables nationwide expansion with no upfront costs. Discover which model is right for your mortgage business!

Mortgage rates have dropped to their lowest levels since December, making homeownership more affordable. Learn what this means for buyers and sellers in today’s market.

Why gamble with unlicensed loan officers when one wrong move could bring everything crashing down? With Peoples Bank’s P&L platform, compliance is built-in—allowing you to operate in all 50 states without individual licensing hassles. No legal risks, no state-by-state roadblocks—just seamless growth on a rock-solid foundation. Operating without proper licensing can lead to fines, lawsuits, and even criminal charges—just ask companies like LoanSnap, 1st Alliance Lending, and RPM Mortgage, which faced costly penalties for non-compliance. With Peoples Bank, you eliminate these risks entirely. Our national charter keeps you compliant, secure, and ready to scale without limits.

Learn how capital gains taxes work when selling your home and how to reduce what you owe. Consult a tax professional for personalized advice.

Mortgage demand is surging as rates drop. Don’t wait—now’s the time to apply and lock in your opportunity before competition heats up.

Mortgage rates have dropped to a 4-month low, creating new opportunities for homebuyers and homeowners looking to refinance. Learn how to take advantage of lower rates today.

In 2025, buying a home is more affordable than renting in most U.S. markets. Learn why homeownership remains the smarter long-term investment.

Home prices are rising at a steady pace, creating great opportunities for buyers and sellers in 2025. Learn how this balanced market benefits you!

Thinking about moving in 2025? Learn why so many Americans are relocating and how to turn your dream move into reality with the right planning

President Trump's executive order targets housing costs, but mortgage rates remain steady. Learn how these changes impact homebuyers and homeowners in 2025.

Explore mortgage trends and homeownership insights this Inauguration Day.

Spend less time on paperwork and more time closing deals with Peoples Bank’s P&L platform. Our turnkey back-office support handles all regulatory and administrative tasks, including compliance, licensing, and loan processing. Plus, with a dedicated HR department, employee onboarding, payroll, and team development are managed seamlessly. Free yourself from red tape, boost efficiency, and focus on production. Ready to scale your success? Visit www.trustpeoplesbank.com to learn more!

Take full control of your mortgage business with the ability to bank or broker loans. With Peoples Bank’s P&L platform, you can set your own margins, charge origination fees, and keep the loan process in-house—or broker out to investors with no restrictions, earning up to 275 basis points per deal. This flexibility allows you to adapt to market conditions, increase revenue streams, and offer tailored solutions to clients. Empower your business with the freedom to choose and grow. Learn more at www.trustpeoplesbank.com

How to decide if you have enough savings to buy a home

Find out what the experts are anticipating for 2025 housing

Learn how to buy a home with low income using practical tips, loan programs, and expert advice. Discover affordable options and assistance programs to make homeownership possible!

Affording a home in today’s market can feel overwhelming, but there are actionable steps you can take to make it easier.